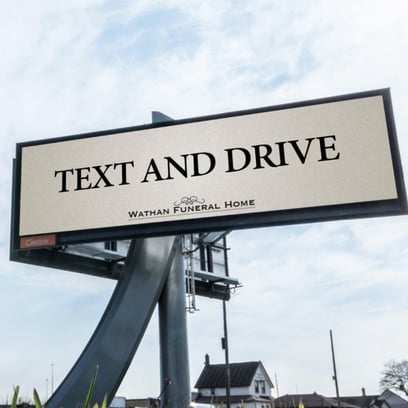

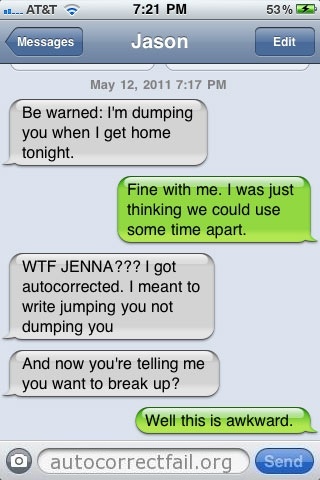

If you are not a commercial loan broker, you can ignore today's training article. Simply enjoy the funny pics and think one more time about investing the bond portion of your diversified retirement portfolio into our first trust deeds yielding 7% to 12%. With rates going up, your bond portfolio is probably getting killed.

If you are a commercial loan broker, today's article shows you a new way to buy commercial leads from C-Loans, even if your credit score is less than 700 and/or your net worth is less than $700,000. Here is a way for you to buy dirt-cheap commercial loan leads - even if we have turned you down in the past!

The Reward:

If you are a commercial loan broker, you should indeed be desperate to buy our commercial mortgage leads. Why? We just sent out a tombstone this week celebrating the 40th commercial loan closing for C-Loans by Glenn Gioseffi of Asset Backed Capital. Forty commercial loan closings! That's a ton of deals for the commercial loan business.

Glenn's story shows you the path to great wealth. Glenn started out as a lead buyer. He bought our leads for the token fee of $1 to $9 up-front, plus 37.5 bps. to C-Loans upon closing one of our leads.

After Glenn had closed five deals, he was added to C-Loans as a Proven Broker. Remember the number five. Five is the magic number. If you buy our leads and close five deals, C-Loans will list your little commercial mortgage company on our Suggested Lender List, alongside some of the biggest banks in the country.

But wait! Its gets even better. Because Glenn had already closed five loans for us, his lender score was augmented by 50 lifetime lender bonus points - 10 points for every closing. In other words, as long as Glenn responded to every one of his leads and maintained a base lender score of 100%, he would enjoy a total lender score of 150%. Such a score would often place him in one of the top six slots on our Suggested Lender List.

From then on, Glenn received numerous custom-selected commercial loan leads in his email box every single day, and he didn't have to pay a dime for them up-front. Of course, he still owed a software licensing fee of 37.5 bps. when he closed a deal.

Not being an idiot, Glenn dove in our leads with a passion and closed more deals. Every time he closed an additional deal, he earned 10 more lifetime lender bonus points. This moved him up the Suggested Lender List, so he saw even more leads. And so on. It was a true case of the rich getting richer.

But Glenn is a rare exception, right? No. Glenn merely joined this week the Over 40 Closings Club, along side Paul Elis and Jason Bengert. Still leading the pack is Les Agisim, who last month founded the Over 50 Closings Club for C-Loans. I'll bet Les has made over $500,000 in loan fees using our leads. Over $1 million? Could be.

The Problem:

But there’s a problem. We here at C-Loans will only allow mortgage brokers with a credit score of at least 700 and a net worth of over $700,000 to buy our leads.

Why are we such meanies? We have been cheated sooooo often by starving mortgage brokers that we had to cut them off. These guys don’t start out with the intention to cheat C-Loans. You’ll recall that Lead Buyers owe us 37.5 bps. when they close one of our leads. Sadly, when a starving mortgage broker closes a C-Loans deal, the temptation to put off paying us "until the next deal closes" is often irresistible. And, of course, they never come back and pay us. So we cut them off. “No soup for you!”

The Earth-Shattering Announcement:

Is your credit only so-so? Is your net worth less than $700,000? Both? Have you applied to C-Loans to buy leads, only to be turned down? There is, effective today, a new way to be granted the privilege of buying dirt-cheat commercial leads from C-Loans.com.

If you enter commercial loans that you find outside of the C-Loans System into C-Loans.com, and you close two loans with C-Loans lenders, we will let you start buying our dirt cheap ($1 to $9) commercial leads. You now have a path to the Over 100 Closings Club.

Example:

One of your favorite real estate agents sends you a commercial loan request. You immediately enter the commercial loan into C-Loans.com. You immediately earn a free commercial mortgage underwriting manual.

Huh? Free what? A free commercial mortgage underwriting manual? You mean I am finally going to learn all of those mysterious underwriting ratios that commercial loan underwriters use, like the debt service coverage ratio, the operating expense ratio, management factors, reserves for replacement, loan constants, and cap rates? For free - just for entering my first commercial loan into C-Loans? Yup.

Hey Brain Surgeons:

You have to actually enter a real-life commercial loan into C-Loans.com. This does NOT mean that you went onto our home page, clicked on a gray button, and filled out a little lead form, in order to get some goodie, like a Free Commercial Loan Placement Kit. No-no-no!

This means that you have to start with Step 1 of 6 and actually submit a real deal to six C-Loans lenders. What we're trying to do here is to show you how the submission process works. Once you have registered on C-Loans.com, and you have submitted your first deal, the next deal should only take you only four or five minutes to submit.

Watch, despite my admonitions, five or six brain surgeons will call or email my son, Tom, the General Manager off C-Loans, Inc., and say, "Where's my free $199 Commercial Mortgage Underwriting Manual? I clicked on the button that said, Free List of 200 Commercial Lenders, and filled out the form." Bona fide brain surgeons. Ha-ha!

Back to Our Example:

Bill Ambitious is a young residential mortgage broker. He wants to move up the food chain to commercial real estate finance. He lacks a four-year degree in finance or accounting, but he has completed a couple of years of junior college, his English skills are superb, he is quite presentable, if not handsome, and he is likable.

He accidentally came across the C-Loans.com web site and discovered that it is a veritable encyclopedia of commercial real estate finance. Not only did he read every page on C-Loans, but he also went back and read every blog article ever written by Old Man Blackburne. (If you go to my blog, in the right-hand column, you will see a list of months and years.) He now had almost complete command of the ratios and the lingo of commercial real estate finance, but he just lacked leads.

He applied to buy commercial leads from C-Loans, but because he was rather new to the business, his credit score was only 670 (student loans), and his net worth was negligible, the big 'ole meanies at C-Loans turned him down to buy leads. How maddening! Where else could he find commercial loan leads for only $1 to $9 apiece. Unfortunately the answer was nowhere. Hmmm.

Then Bill Ambitious read Big George's latest blog post, and he realized that there was finally a way for him to buy leads and work his way onto C-Loans. If only he could close two deals on C-Loans.com and win the right to start buying dirt-cheap commercial leads!

Now Bill Ambitious was still doing a little marketing on his own. He had the words, "Commercial Loans", prominently displayed on his business cards, his rate sheets, and his fliers. He had also built himself a small mailing list of bankers located near his office who were making commercial loans. He traded a list of ten of his bankers to George for George's famous, nine-hour video training course, "How To Broker Commercial Loans" ($549 retail).

Every week Bill Ambitious printed up a cute, clean joke (he stole the jokes from George) on plain, 'ole copy machine paper. He snail-mailed the joke to all 67 of his bankers, along with three of his business cards. The technique worked well, and he was soon receiving four or five bank commercial turndowns every week.

But it was a lead from one of his realtors that provided his first opportunity to post a loan on C-Loans.com. The loan was just a $100,000 loan request on a little house being used as a real estate office. Now normally Bill Ambitious would not have bothered with a commercial loan this small; but he was electrified by the possibility of closing two loans for C-Loans.

He entered the deal into C-Loans.com, using the six-step process, and within minutes he got an offer from a Wall Street nonprime lender listed on C-Loans. The deal closed. Hooray! He promptly notified Tom Blackburne, the old man's son who runs C-Loans, so there would be a record of the closing. "Hmmm," said Tom. "This lender never paid us on this closing. Here's $50, Bill, for keeping them honest."

Four months later, Bill Ambitious, closed his second loan for C-Loans - a $1.6 million multifamily loan that he closed with a hungry Agency lender found on C-Loans. Eureka! Within two days of notifying Tom Blackburne of his second closing, Bill Ambitious was finally granted access to the Lender Vault on C-Loans.com.

Like a starving man finally let loose on a cruise ship buffet (my seventh grade English teacher would have loved that metaphor), Bill Ambitious pounced on the leads. Within seven more months, Bill had his five closings (commercial loans take some time to close). Tom Blackburne was thrilled for him, and he had Ambitious Commercial Mortgage, LLC added as a Proven Broker to the list of lenders on C-Loans.com within an hour. Bill received two commercial loan applications before he even went home that first night.

Bloody Circus:

Now Les Agisim and Glenn Gioseffi are competitive men by nature. Whenever a tombstone, announcing another closings for Ambitious Commercial Mortgage, appeared in their email box, they were happy for Bill. At first. But after Bill had closed 37 commercial loans for C-Loans in less than two years, they started to look back over their shoulders. Like the chariot drivers of old, racing in the Circus in Rome, they urged their horses onward. Who would be the first Proven Broker to found the Over 100 Closings Club? Snap! Crack! Race on, my lovelies!

Did you know that a Circus was a chariot racing arena? "Give them bread and circuses." The classic Biblical movie, Ben Hur, was deadly accurate when it depicted bloody violence in these chariot races. The teams were represented by colors - the Blues, the Greens, etc. - and bloody riots between the fans of the different colors were not uncommon. In the famous Nika Riot, tens of thousands of people were killed! The Crips and the Bloods have nothing on the ancient Romans. "What has been will be again, what has been done will be done again; there is nothing new under the sun." -- Ecclesiastes 1:9.

Bottom Line:

Great wealth potentially awaits you - if you can get approved to buy commercial loan leads from C-Loans. Look for any excuse to enter a commercial loan request into C-Loans.com. If you can close just two of them, the future is so bright that you gotta wear shades.

A Final Word on Proven Brokers:

In my training classes, I teach my students to never take their commercial loans to another broker. Broker-broker deals almost never close.

I hereby make one exception to that general rule. Your chances of closing a deal with one of our Proven Brokers are about ten times higher than with one of our garden-variety, sleepy, indifferent banks.

These Proven Brokers have a special relationship with a handful of hungry banks that allows them to get deals "on the bubble" approved.

Whatever Happened To Our Friend, Bill Ambitious?

Old Les Agisim beat him to the finish line, but Bill Ambitious ended up making FAR more money. You see, Bill Ambitious bought my four-hour course, How To Find Your Own Private Mortgage Investors. In that course, Bill had noted that I taught him to collect the contact information of every wealthy borrower he met. Bill did that religiously, whether or not the loan closed. After four years, Bill sent an individually word-processed letter to each of the accredited investors that he had met as a borrower.

Dear Dr. Allen:

Back in May of 2019, we had the pleasure of working on a $2.3 million first mortgage for you on your shopping center in Columbus, Ohio. Today I am writing to you about investing in our 10% first mortgage investments.

The response was overwhelming, and Bill now services $126 million in hard money loans for his 1,983 private investors. His loan servicing income is currently $255,000 per month, whether he closes a new loan or not. He is able to take his lovely bride of 16 years, along with their four beautiful children, on cruises and incredible vacations at least four times per year.

This is all because he closed two loans using C-Loans.com. And folks, we have been in business since 1980. My two sons, George IV (33) and Tom (32), will help Angela Vannucci - our heir apparent - to continue the legacy.

You really-really-REALLY want to be special friends with Blackburne & Sons / C-Loans, Inc. Blackburne & Sons was one of the few lenders that was in the market, making new commercial loans, every day of the Great Recession.

You will spot the line item, Effective Gross Income, in the top third of any Pro Forma Operating Statement. By the way, a line item is a separate line in a financial statement or budget. For example, "Real Estate Taxes", "Utilities Expense", and "Fire Insurance" are all examples of line items in a Pro Forma Operating Statement.

You will spot the line item, Effective Gross Income, in the top third of any Pro Forma Operating Statement. By the way, a line item is a separate line in a financial statement or budget. For example, "Real Estate Taxes", "Utilities Expense", and "Fire Insurance" are all examples of line items in a Pro Forma Operating Statement.

You own a four-unit strip commercial center that was 100% vacant just three years ago. You hired a superb leasing agent, who convinced you to offer one year's free rent upon the execution of a five-year lease. Your strip center quickly leased up, and it is now 100% leased to a liquor store, a karate studio, a nail salon, and a Sports Clips (barber shop for men). Each unit now pays you $3,000 per month. Life is grand.

You own a four-unit strip commercial center that was 100% vacant just three years ago. You hired a superb leasing agent, who convinced you to offer one year's free rent upon the execution of a five-year lease. Your strip center quickly leased up, and it is now 100% leased to a liquor store, a karate studio, a nail salon, and a Sports Clips (barber shop for men). Each unit now pays you $3,000 per month. Life is grand.

One expert recently described buying a franchise as getting a 30-yard head start in a 100-yard dash.

One expert recently described buying a franchise as getting a 30-yard head start in a 100-yard dash.

This article should be particularly interesting to accredited investors, commercial brokers (realtors), and commercial mortgage brokers because it describes a way for you to find the Holy Grail of real estate -

This article should be particularly interesting to accredited investors, commercial brokers (realtors), and commercial mortgage brokers because it describes a way for you to find the Holy Grail of real estate -

Dan Harkey has worked for over 45 years in the hard money lending business. (To old veterans like myself, Dan is respected as an icon.). He currently consults with borrowers in need of hard money loans. Dan can be reached at 949-533-8315 or at dan@danharkey.com.

Dan Harkey has worked for over 45 years in the hard money lending business. (To old veterans like myself, Dan is respected as an icon.). He currently consults with borrowers in need of hard money loans. Dan can be reached at 949-533-8315 or at dan@danharkey.com. All of my work life I have heard smart real estate people use fancy terms like conforming, legal nonconforming, illegal nonconforming, conditional use permits, and variances. I would always nod my head and try to look intelligent, but the truth is that I never knew what the heck they were talking about.

All of my work life I have heard smart real estate people use fancy terms like conforming, legal nonconforming, illegal nonconforming, conditional use permits, and variances. I would always nod my head and try to look intelligent, but the truth is that I never knew what the heck they were talking about.

Dan Harkey has worked for over 45 years in the hard money lending business. (To old veterans like myself, Dan is respected as an icon.). He currently consults with borrowers in need of hard money loans. Dan can be reached at 949-533-8315 or at dan@danharkey.com.

Dan Harkey has worked for over 45 years in the hard money lending business. (To old veterans like myself, Dan is respected as an icon.). He currently consults with borrowers in need of hard money loans. Dan can be reached at 949-533-8315 or at dan@danharkey.com. What on earth is a TIC roll-up? Do they bite when you try to roll them up?

What on earth is a TIC roll-up? Do they bite when you try to roll them up?

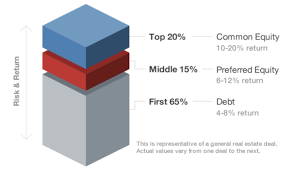

I have a real treat for you today. A buddy of mine, Yoni Miller of

I have a real treat for you today. A buddy of mine, Yoni Miller of

QuickLiquidity is a direct lender and preferred equity investor providing equity recapitalizations, subordinated debt and partner buyouts on commercial real estate nationwide. QuickLiquidity allows real estate owners to monetize their existing equity while maintaining majority ownership and control of their property without disturbing their existing first mortgage or triggering any prepayment penalties. For more information you can visit www.quickliquidity.com/recapitalizations.html or call Yoni Miller 561-221-0881.

QuickLiquidity is a direct lender and preferred equity investor providing equity recapitalizations, subordinated debt and partner buyouts on commercial real estate nationwide. QuickLiquidity allows real estate owners to monetize their existing equity while maintaining majority ownership and control of their property without disturbing their existing first mortgage or triggering any prepayment penalties. For more information you can visit www.quickliquidity.com/recapitalizations.html or call Yoni Miller 561-221-0881.