I got an email today from one of my former students, and he was starving as a commercial loan broker. In order to help him, I sent him a little questionnaire about his struggles as a commercial loan broker. My initial thought was that if I could pinpoint at which step he was struggling, then I could help him. Then I realized, why I don't I help a whole bunch of commercial loan brokers? So here we go.

I got an email today from one of my former students, and he was starving as a commercial loan broker. In order to help him, I sent him a little questionnaire about his struggles as a commercial loan broker. My initial thought was that if I could pinpoint at which step he was struggling, then I could help him. Then I realized, why I don't I help a whole bunch of commercial loan brokers? So here we go.

What I am about to say is going to sound like a giant sales pitch, but it's the truth. If you are struggling as a commercial loan broker, you really should take the course that I wrote just for struggling commercial loan brokers - The Practice of Commercial Loan Brokerage. Theory is great. So are the financial ratios and the commercial real estate finance ("CREF") terms of art. But if you starve to death because you don't know where to focus your time, then it's all for naught.

Now on to the questionnaire:

1. Is your problem that you simply aren't getting any commercial loan leads at all?

You need to learn how to market for commercial loans. What does NOT work - at all - ever - not even a little bit - I really mean NEVER - is the advertise to potential borrowers for commercial loans.

What DOES work is to advertise to potential referral sources, such as banks, commercial brokers, property managers, other commercial lenders, residential mortgage brokers (on a name and number referral fee basis only), residential real estate brokers, CPA's, attorneys, and financial planners (life insurance salesmen).

If money is tight and marketing for commercial loans is big problem for you, you should take my course, Marketing for Commercial Loans. If you are are flat-out starving, you can trade one banker for our commercial mortgage marketing course.

2. Is your problem that you are not getting enough leads?

You are probably wasting valuable time trying to place crumby commercial loans. I'll cover crumby commercial loans in more detail below.

If you need more commercial leads, you need to realize that 70% of a commercial loan broker's time should be spent marketing to bankers, commercial brokers (commercial real estate salesmen), property managers, other commercial lenders , residential mortgage brokers for referrals only, residential real estate brokers, CPA's, attorney's, and life insurance agents. In plain English, use the time you might spend chasing crumby commercial loans to add to your list of referral sources.

By the way, for $1,000 per year, you can buy one to five commercial leads per day.

3. Is your problem that the commercial loan leads you are getting are crumby?

First of all, you need to quickly spot a crumby commercial loan - big land loans (the borrower's net worth has to be at least as large as the loan amount), construction loans for developers who can't cover 30% of the total cost of the project, international loans, and loans involving some sort of "special financial instrument" (letters of credit, bond financing, tax credits, etc.). You will never buy even a package of Ramen to feed your family if you work on such loans.

Instead, quickly reject such loans and go back to spending nine hours per day marketing to your referral sources. If you are adding fewer than a dozen new potential referral sources to your email list every day, you are not working smartly.

Seventy percent of a commercial loan broker's time should be spent on marketing for commercial loans.

4. Is your problem that you can't convince the borrowers to send you the package?

If so, you must sound unknowledgeable on the phone. Your borrowers must think that you are a bumbling idiot. Its time to learn the profession of commercial loan brokerage! Learn your stuff.

Now ideally you can afford a modest $549 to learn a profession. Four years of tuition to get a bachelor's degree in finance costs $225,000. I can teach you the entire profession of commercial mortgage brokerage in one incredibly long day for just $549. Just one day. This course was videotaped before a live audience, and I taught the entire course in one day. Phew. I would sleep for twelve hours afterwards.

But let's suppose you are a starving commercial loan broker. You can't afford $549. Then at least trade for my commercial loan underwriting manual. All you have to do is to call a bank located near your office, get the name, contact information, and email address of their commercial real estate loan officer, and trade that one banker for my wonderful Commercial Loan Underwriting Manual. At least you'll learn the ratios and the terminology of the commercial loan business.

5. Is the problem that you can't find banks to approve your commercial loan?

Have you tried entering your commercial loan into C-Loans.com? C-Loans is 100% free to commercial loan brokers to use, and it will identify 20 to 30 hungry commercial lenders suitable for your particular commercial loan.

The advantage that C-Loans has over CommercialMortgage.com ("CMDC") is that C-Loans lists a ton of subprime commercial lenders. CommercialMortgage.com is best for finding banks and credit unions for "A" quality deals. C-Loans.com has those weird, loosy-goosy commercial lenders that actually feed a commercial loan broker.

If you like the idea of having your own list of commercial lenders, you can trade one banker for a list of 750 commercial lenders.

6. Is your problem that your borrowers won't sign your lender's term sheets?

Fudge them. You might just need to move on to the next deal. I know it's heart-breaking, but you can't force a borrower to need a commercial loan.

In order to close two to three commercial loans per month, you need to have ten to twelve loans in process at all times. To have 10 to 12 loans in process, you need to be working at least eight good leads per day.

To have receive eight good leads per day, you need to have a list of referral sources of 4,000 (?). To have a list of 4,000 referral sources, you need to be adding a dozen new referral sources to your email list every day.

A very wise old commercial mortgage broker once said, "Seventy percent of a commercial loan broker's time should be spent on marketing for commercial loans."

7. Is your problem that borrowers are cheating you out of your fee?

You and I have different definition of "cheating you out of your fee." You think I am referring to commercial loan borrowers who close the deal and don't pay you. That very seldom happens.

What happens far more often is that the borrower cancels on you on the 5-yard line. "My wife won't let him take the loan," even though he has signed some lender's term sheet. You worked your butt off delivering that term sheet, and now this multi-millionaire borrower wants to walk and away and tell you to, "Make it up on the next borrower." Or the SOB lied to you about the property being leased.

Fudge him. If you were not absolutely starving, you should take my invaluable 90-minute video training course, "Fee Collection Course." It is fair to say that I have made over $1 million during my career collecting loan fees from defaulting, lying, and fraudulent borrowers. I collected $37,000 just last week.

Did you know that I got so fed up with lying, fraudulent borrowers that I went to law school at night, with two kids in diapers, and never missed a single class in four years of law school, passed the California State Bar Exam (40% pass rate), and never practiced law. I went through this torture just to develop this fee agreement.

But you may be starving. If so, you can trade me one one banker for my famous fee agreement.

8. Are you smarter than the average commercial loan broker?

If so, rather than just finding me four bankers, you'll find me 20 bankers. I will trade you a free copy of my famous 9-hour course, How to Broker Commercial Loans. Just send me, George Blackburne III (the old man), an email with the subject line, "Trade For 20 Bankers." I get 1,350+ emails per day, so it will be easy for me to miss your trade. After sending your email, please text me at 574-360-2486, "I just sent you 20 bankers."

And once you start building a list of bankers, you have begun the all-important task of building a huge network of referral sources. Remember, advertising directly to the public for commercial loans absolutely does NOT work. You need referral sources to get commercial loan leads.

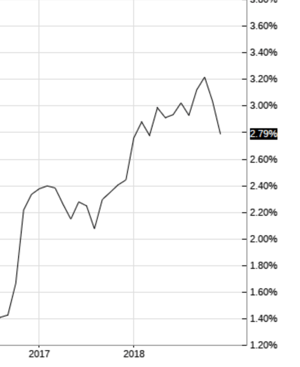

Whenever a commercial mortgage lender offers you or your client an adjustable mortgage loan (AML), it is very important that you compute the implied rate before accepting the loan. The implied rate is the sum of some index plus the spread.

Whenever a commercial mortgage lender offers you or your client an adjustable mortgage loan (AML), it is very important that you compute the implied rate before accepting the loan. The implied rate is the sum of some index plus the spread.

Swap spreads is another popular index in commercial real estate finance. Swap spreads is the difference between the swap rate (a fixed interest rate) and a corresponding government bond yield with the same maturity (Treasury securities in the case of the United States). ... The swap rate therefore is simply the yield on an equal-maturity Treasury plus the swap spread.

Swap spreads is another popular index in commercial real estate finance. Swap spreads is the difference between the swap rate (a fixed interest rate) and a corresponding government bond yield with the same maturity (Treasury securities in the case of the United States). ... The swap rate therefore is simply the yield on an equal-maturity Treasury plus the swap spread.

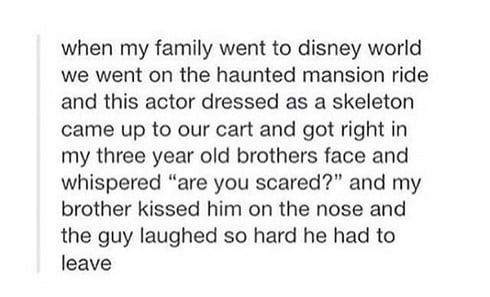

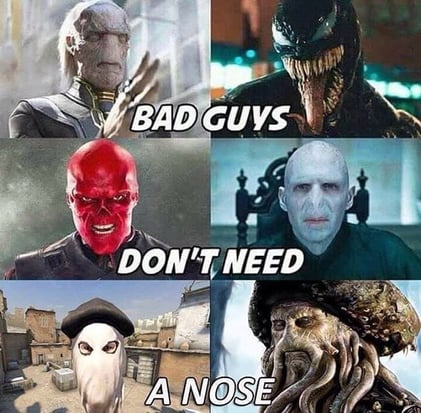

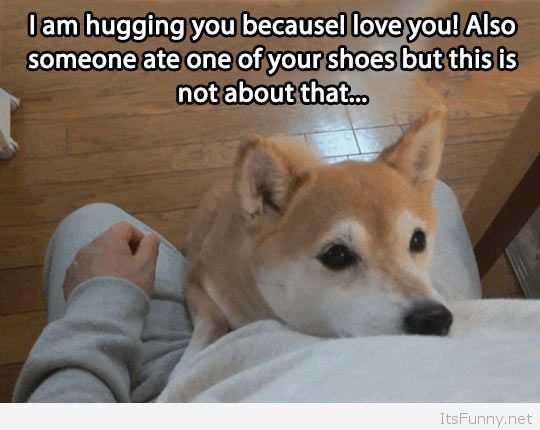

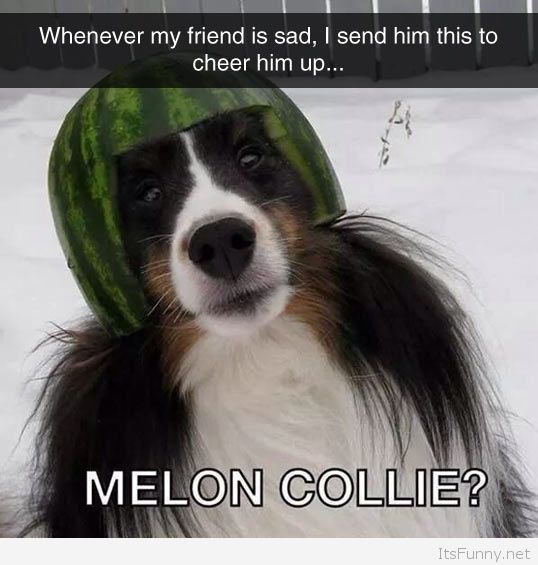

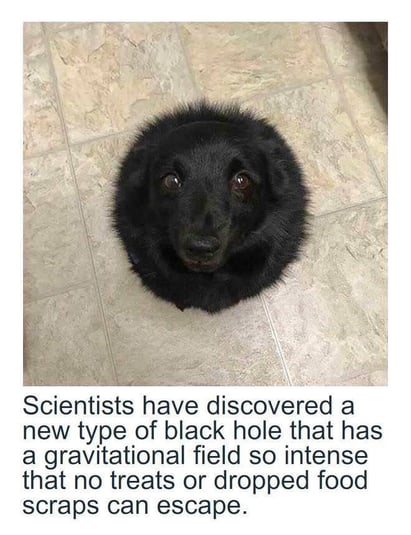

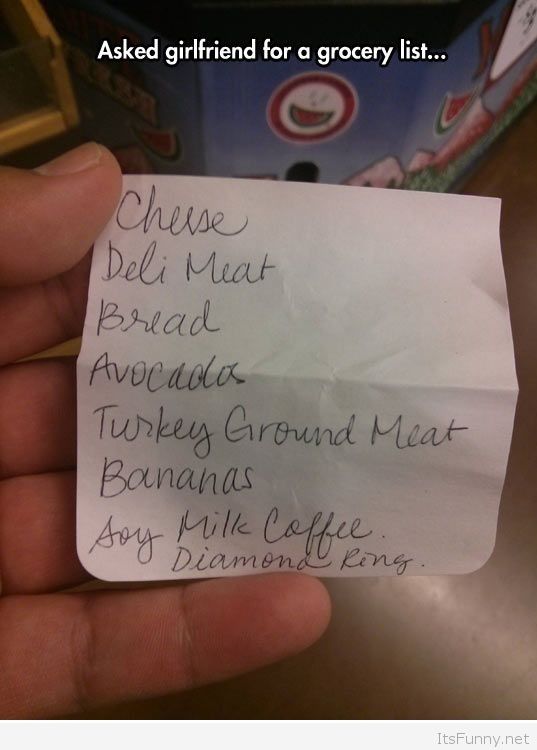

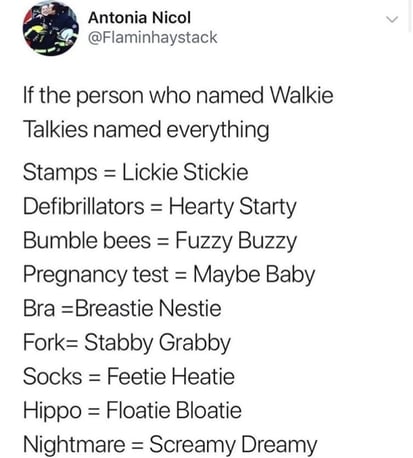

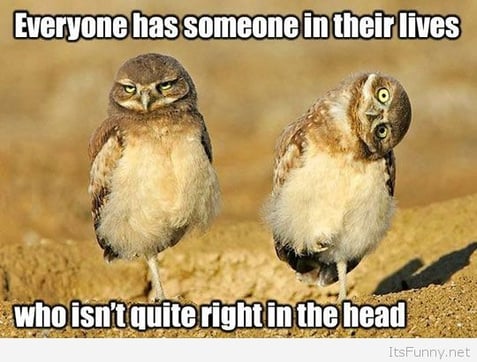

I have no lessons about commercial loans today. Instead, let's just have some fun on this relaxing Boxing Day.

I have no lessons about commercial loans today. Instead, let's just have some fun on this relaxing Boxing Day.

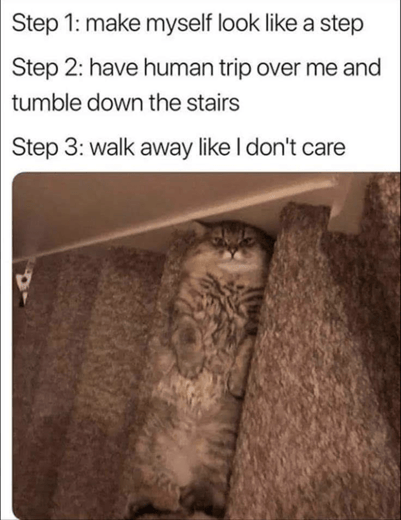

So I told you that we have a dog door for our animals to go out, but wild animals can come in using that door. We first realized that we had a problem when we discovered that local raccoons were carefully washing their paws in our water bowl before dining on our dog food. "For these gifts we are about to receive..." Then the HUGE neighborhood tom cat got trapped by our dogs in our house. That darned cat was so big and fierce that he had absolutely no fear of me. I found myself backing up. Buck-buck-buck. Haha!

So I told you that we have a dog door for our animals to go out, but wild animals can come in using that door. We first realized that we had a problem when we discovered that local raccoons were carefully washing their paws in our water bowl before dining on our dog food. "For these gifts we are about to receive..." Then the HUGE neighborhood tom cat got trapped by our dogs in our house. That darned cat was so big and fierce that he had absolutely no fear of me. I found myself backing up. Buck-buck-buck. Haha!

Perhaps you sold a small commercial building, and you carried back a commercial loan; or perhaps you

Perhaps you sold a small commercial building, and you carried back a commercial loan; or perhaps you

Contracts of sale come up modernly when fix-and-flippers sell their recently renovated houses to buyers who lost their prior home during the Great Recession. These receivables are a terrific source of cash flow and wealth, and in my next blog article we are going to talk about how to value them, how to sell them, and how to borrow against them.

Contracts of sale come up modernly when fix-and-flippers sell their recently renovated houses to buyers who lost their prior home during the Great Recession. These receivables are a terrific source of cash flow and wealth, and in my next blog article we are going to talk about how to value them, how to sell them, and how to borrow against them.

The Huns were not the same race of people as the Mongols. Genghis Khan led his hordes into China, across Russia, and into Europe in the 13th Century (1210-1260). The Huns were from a much earlier time. The Huns were a nomadic people who lived in Central Asia, the Caucasus, and Eastern Europe, between the 4th and 6th century AD.

The Huns were not the same race of people as the Mongols. Genghis Khan led his hordes into China, across Russia, and into Europe in the 13th Century (1210-1260). The Huns were from a much earlier time. The Huns were a nomadic people who lived in Central Asia, the Caucasus, and Eastern Europe, between the 4th and 6th century AD.

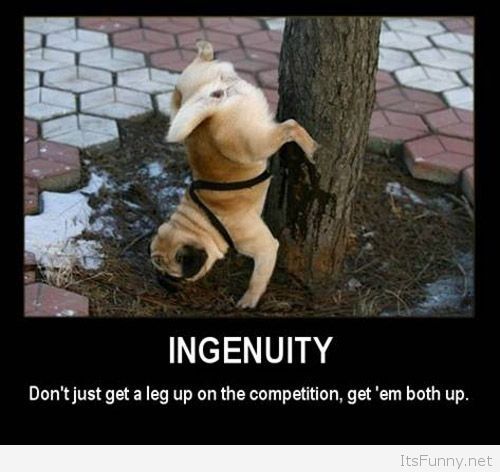

In my last two blog articles, I have been pounding on the theme that a commercial loan broker must not waste his valuable time working on goofy loans. Instead, he must spend his precious time building and expanding his list of 4,000+ referral sources.

In my last two blog articles, I have been pounding on the theme that a commercial loan broker must not waste his valuable time working on goofy loans. Instead, he must spend his precious time building and expanding his list of 4,000+ referral sources.

I got an email today from one of my former students, and he was starving as a commercial loan broker. In order to help him, I sent him a little questionnaire about his struggles as a commercial loan broker. My initial thought was that if I could pinpoint at which step he was struggling, then I could help him. Then I realized, why I don't I help a whole bunch of commercial loan brokers? So here we go.

I got an email today from one of my former students, and he was starving as a commercial loan broker. In order to help him, I sent him a little questionnaire about his struggles as a commercial loan broker. My initial thought was that if I could pinpoint at which step he was struggling, then I could help him. Then I realized, why I don't I help a whole bunch of commercial loan brokers? So here we go.

You really should pay close attention to what I am teaching you here. This is the meat-and-potatoes of commercial real estate finance ("CREF").

You really should pay close attention to what I am teaching you here. This is the meat-and-potatoes of commercial real estate finance ("CREF").

Does the SBA have a minimum credit score? What if I was forced to declare bankruptcy during the Great Recession? Is it still possible for me to get an SBA loan?

Does the SBA have a minimum credit score? What if I was forced to declare bankruptcy during the Great Recession? Is it still possible for me to get an SBA loan?

"China is already challenging the US for technological and geopolitical primacy and flaunting its authoritarian capitalism as an alternative to democracy. Communism couldn’t pose a credible challenge to liberal democracy, but authoritarian capitalism might. In that sense, China’s model represents the first major challenge to liberal democracy since the rise of Nazism.” — Brahma Chellaney,

"China is already challenging the US for technological and geopolitical primacy and flaunting its authoritarian capitalism as an alternative to democracy. Communism couldn’t pose a credible challenge to liberal democracy, but authoritarian capitalism might. In that sense, China’s model represents the first major challenge to liberal democracy since the rise of Nazism.” — Brahma Chellaney,