I have often said, "There is no better way to meet high-net-worth investors than to be a commercial mortgage broker."

Even if you are a commercial real estate broker (aka "commercial broker"), you should open a commercial mortgage company and broker some commercial loans on the side, when sales are slow - just for the opportunity to meet wealthy investment property investors. In my role as a commercial mortgage lender, today I met the investment manager of a family office. Folks, this is a huge deal! This could potentially be a very important contact.

A family office is usually a small company of three or four employees that manages the investments and the business affairs of a single, extremely wealthy family. Usually we're talking about investment portfolios in excess of $30 million, and some family offices manage investment portfolios as large as $500 million or more.

A family office does far more than merely manage the family's investment portfolio. A family office will also provide for tax compliance work, access to private banking and private trust services, document management and recordkeeping services, expense management, bill paying, bookkeeping services, family member financial education, family support services, and family governance.

Whether you are a commercial broker or a commercial mortgage banker, you need to develop a fun newsletter with which you can stay in touch with your clients. At Blackburne & Sons, we use iContact.com as our newsletter service. I think it costs less than $60 per month to send out 4,000 email newsletters every business day.

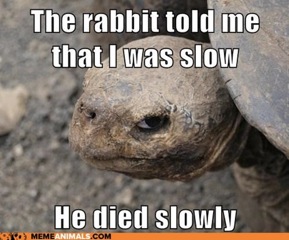

I will try to stay in contact with this family office investment manager by sending him lots of folksy, fun, down-to-earth, opposite-of-professional newsletters. In every newsletter I will include lots of jokes, funny pics, and cool videos. I will also try to reach him with a newsletter every three weeks for decades.

I call these the fun treats in my newsletters "Rat Goodies". Back in the 1960's a famous psychologist, B.F. Skinner, conditioned rats to press a lever to get a rat goody. If we can condition rats to press a lever to get a rat goody, we should be able to encourage our friends, clients, and pen pals to look forward to our newsletters (and blog articles) because they always include fun treats.

"Gee, George, are you trying to condition me?" Yes, I am, but its for a noble purpose - so we can make money together and have fun doing it.

Last year I started selling The Blackburne List, a list of 2,000 commercial real estate lenders who said, "No," when we asked them to join C-Loans.com. We would sell maybe two or three copies of the list every week at $39.95.

Then we added the opportunity to get The Blackburne List for free, merely for trading us the name and the contact information of one banker making commercial loans. It's a helluva deal for the guy making the trade - 2,000+ bankers for just one. Not surprisingly we're making one to two such trades per day.

But the thing that is blowing my mind is that outright sales of The Blackburne List have tripled. For some reason many guys would prefer to pay the $39.95 rather than give up the name of one of their bankers. Go figure. We're happy either way.

We're still dancing in the aisles here at C-Loans over our closing this week of an $18.5 million construction loan on a mixed-use project in Wisconsin. If you had brokered that deal and charged the borrower 50 basis points, your commission would have been a whopping $92,500. What would you do with $92,500?

By the way, a basis point, often abbreviated "bps." and pronounced bips, is just 1/100th of a point. Therefore 50 basis points is 50/100ths of a point ... or one-half point.

C-Loans.com has closed over 1,000 different commercial real estate loans totaling over $1 billion. "Yeah, yeah, George, I 've heard you say that a dozen times."

But here's the thing that you need to understand: The Suggested Lender List for every commercial loan search is different. Different lenders make different size and types of commercial loans. Just because you have a disappointing response to one commercial loan - say, a $275,000 loan on a bar in the ghetto to a guy with poor credit - doesn't mean that you won't meet tons of dreamy lenders on a different deal - say, a $3 million loan on an apartment building in Austin, Texas.

Here's your final treat for the day:

Stop the presses! Jeff Smith of StarFury Capital Management just asked me, "Ok, George, that sounds great. Now how can we mere mortals meet the high execs of family offices?"

The answer is to broker commercial loans! The larger the loans that you broker, the wealthier your borrowers will be. Remember the Net-Worth-To-Loan-Size Ratio says that the borrower's net worth should be at least as large as the loan size requested (1.0 ratio). If you work only on $10 million loans, you should meet plenty of guys with a net worth of $10+ million.

And when you "meet" a wealthy investor - even if its only over the phone and even if you only quote him a loan - keep marketing to him for years. That's how I built my $50 million hard money shop. Every time I met a high-net-worth commercial borrower, for the four years leading up to when I started selling trust deed investments, I saved his contact information and kept my name in front of him with my newsletters.

This investor was special. I had met him in the legitimate course of business. With him, I had legitimacy. I earn 2% per year for loan servicing. Do the math on $50 million in servicing.

Grasp this concept: Every one of my early trust deed investors was a former borrower! It's a strange notion, but an investor is an investor. The same guy who invests in large apartment buildings, and hence needs a big apartment loan, is also the guy who buys stocks and trust deeds. An investor is an investor.