One day Sammy Shopper, a thrifty and tight-fisted Scottish American, called every bank within 50 miles to find the best commercial loan for his office building. Guess what he found? Just about every bank quoted him the same rates and terms:

One day Sammy Shopper, a thrifty and tight-fisted Scottish American, called every bank within 50 miles to find the best commercial loan for his office building. Guess what he found? Just about every bank quoted him the same rates and terms:

- 3.97% to 4.81 fixed for the first five years

- 25 years amortized

- 10 years due

- Rate readjusted at the beginning of year 6

- Modest prepayment penalty of either 3-2-1 or 1 point.

Commercial bankers are herd animals. They enter and leave markets with the herd (invariably much too late), and they all quote just about the same commercial loan. If you know what a community bank in White Plains, New York is quoting on a commercial loan, you pretty much know what a community bank in Fresno, California is quoting on a similar commercial loan.

If you ever need to know what banks are quoting on commercial loans, simply go to our web site devoted solely to what banks are quoting on commercial loans, CommercialMortgageRates.co. We update these commercial mortgage rates every week, so be sure to bookmark this page. Please note that the extension is ".co" rather than ".com". I had the chance to buy the ".com" version of this domain name, but the seller wanted $20,000; and one of my many web pages was already #1 on page 1 of Google for "commercial mortgage rates."

We often get calls from commercial borrowers trying to beat the rate quoted to them by their own bank. I have a saying, "The only commercial lender who can beat a borrower's own bank is his mother." It therefore seldom pays to spend hours and hours calling different banks in search of a lower rate. Banks are all going to be about the same.

Where banks will differ, however, is in the amortization and the loan amount. The typical amortization for a commercial loan is 25 years; but due in 10 years. Twenty-five years is to commercial loans what 30 years is to residential loans. Its the typical amortization. Let's suppose, however, that your commercial building is 45 years-old, and it is showing signs of deferred maintenance. Many banks will shorten their amortization schedule to just 20 years, thereby increasing your monthly payments and reducing the size of the loan for which you can qualify. In a case like this, it pays to shop for a different bank who will use a 25-year amortization.

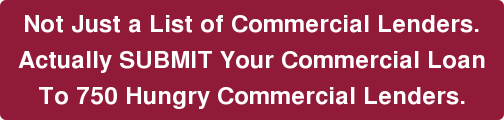

Another reason to shop banks for the best commercial loan is the loan amount. Banks can vary significantly as to how much they will loan you. Some banks today are still stuck in a Great Recession mentality, and they will only loan up to 60% to 65% loan-to-value. Other, hungrier banks, will loan up to 70% to 72% LTV; but unfortunately few of them ever reach 75% LTV.

If you ever absolutely need a commercial loan of a full 75% loan-to-value, consider submitting your deal to Blackburne & Sons. Because we use private investors to make our loans, we cannot possibly compete with the banks on rates. Therefore Blackburne & Sons has to compete on the basis of giving the borrower more loan proceeds. In other words, Blackburne & Sons regularly wins deals because we actually make loans up to 75% LTV. We might even consider a non-SBA commercial loan of 80% LTV on the right purchase-money deal. A purchase money loan is a mortgage loan used to purchase the property

Every one you - including commercial property investors and commercial brokers - needs at least a small Rolodex of six to eight bank commercial real estate loan officers. You commercial mortgage brokers need a Rolodex of at least 30 to 50 bankers. Now CommercialMortgage.com - our commercial lender search engine - can serve as your actual Rolodex; but you still need to develop a personal relationship with each of your bankers.

The reason why you need a personal relationship with lots of different bankers is because bankers are fickle, moody, and totally unpredictable. One moment a bank will love loans on self storage projects, and the next moment - usually after a loss - the bank wouldn't touch a self storage loan with a fifty-foot pole.

Therefore you need to have a bunch of different bankers to whom you can show your commercial loan, in hopes of finding that one bank who is in the mood to lend today. A bank will often feel pressure to lend after some big commercial loan in their portfolio pays off.

It's easy to start adding bankers to your Rolodex. There are 6,799 commercial banks in the U.S. today, and just about every bank in the country is in the market right now to make commercial real estate loans. Remember, bankers move in herds. Just call up the bank down the street and ask for a commercial real estate loan officer. Ask for his direct phone number, his address, and his email address. Lastly, you'll need to know his minimum and maximum commercial loan size and his lending area. Voila! That's all you need to ask. You don't need his rates (see above), nor do you need to know what types of properties the bank will finance (see below).

If the borrower is strong, and there is a potential for a continuing business relationship, most banks will finance most of the property types listed below. The only qualification is that banks will only finance business properties if the business is making money.

Multifamily

Office Buildings

Retail buildings, Strip Centers, and Shopping Centers (and such condos)

Industrial Buildings and Warehouses (and such condos)

Hotels and Motels*

Self Storage (aka Miniwarehouses)

Auto Repair

Restaurants and Bars*

Gas Stations*

Residential Subdivisions and Land**

* If they are making good money.

** If the developer has a high net worth, lots of experience, and a ton of cash in the deal.

As to loan type, most banks usually have a good appetite for both permanent loans and commercial construction loans. A permanent loan is a garden-variety first mortgage on a commercial property with a loan term of at least five years and at least some principal paydown (usually 25-years amortized).

So in conclusion, we know right off the bat that -

- Almost every one of the 6,799 banks in the country is now making commercial loans.

- Most of these banks will consider both permanent loans and construction loans.

- The typical bank will consider almost all commercial property types, as long as the business owner is making good money.

- The rate is going to be between 3.87% and 4.91%.

- The loan will have a 25-year amortization

- The loan will have a term of 10 years, with a rate readjustment after 5 years.

- A modest prepayment penalty of 3-2-1 or 1 point is common.

- Therefore all you really need to know from your bank loan officer is his mimimum loan, his maximum loan, and his lending area.

- You need a rolodex of bank loan officers, but these guys (or gals) are easy to meet. Just call the bank and ask for a commercial real estate loan officer.

Today I am going to teach you how to convince a bank to close a commercial loan on a building where part of the space is vacant. Before we get into this discussion, however, please allow me to pitch a private money loan from

Today I am going to teach you how to convince a bank to close a commercial loan on a building where part of the space is vacant. Before we get into this discussion, however, please allow me to pitch a private money loan from

Once upon a time, Mary Flakey bought an apartment building for $1 million from Mr. and Mrs. Jones, an elderly couple. Mary put down $150,000. She then took title to the apartment building "subject to" the existing $550,000 first mortgage from Choppy Bank, and Mr. and Mrs. Jones carried back a $300,000 second mortgage at just 6% interest.

Once upon a time, Mary Flakey bought an apartment building for $1 million from Mr. and Mrs. Jones, an elderly couple. Mary put down $150,000. She then took title to the apartment building "subject to" the existing $550,000 first mortgage from Choppy Bank, and Mr. and Mrs. Jones carried back a $300,000 second mortgage at just 6% interest.