Our friends at George Smith Partners publish every week an excellent commercial real estate finance newsletter called FinFacts. I try to send a copy to my staff every week to enhance their understanding of the language and terminology of commercial mortgage finance.

This weeks the folks at George Smith Partners used a number of big, fancy, finance-ese terms that my staff asked me to clarify.

Coupon:

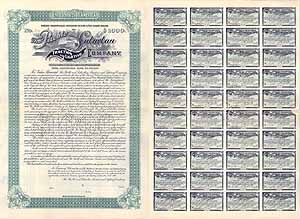

You've probably heard the term, "clipping coupons". In the old days, corporations would issue bonds to investors with little coupons attached that could be cut off. Every month little widows would go down to the bank and clip off one of the coupons and redeem it for one month's interest, with which the widow would buy her groceries and pay her rent.

You've probably heard the term, "clipping coupons". In the old days, corporations would issue bonds to investors with little coupons attached that could be cut off. Every month little widows would go down to the bank and clip off one of the coupons and redeem it for one month's interest, with which the widow would buy her groceries and pay her rent.

The coupon rate is therefore the interest rate on the note that the borrower actually pays every month. In most cases, the coupon rate is the same as the note rate, but not always. You could have a note with an interest rate of 17% and a coupon rate of 10%. The borrower would pay interest to the lender every month at the annual rate of 10%, and the difference between 10% and 17% would simply accrue and defer.

Carve-Outs:

A non-recourse commercial loan is one where the borrower does NOT have to personally guarantee the commercial loan. There are some exceptions, however, to the general rule that the borrower is not personally responsible to the commercial lender for any losses on a non-recourse commercial loan. These exceptions are known as carve-outs.

If the borrower commits certain Bad Boy Acts, the borrower is suddenly subject to a springing personal guaranty. Here is a partial list of those Bad Boy Acts:

- Fraud

- Toxic Contamination

- Intentional Waste (Taking a sledgehammer to the building)

- Placing a Second Mortgage on the Property

- Converting (Stealing) Insurance Proceeds

Mini-Perm:

A permanent loan is a first mortgage on a commercial property with some amortization, usually 25 years, and a term of at least five years.

A mini-perm is a commercial first mortgage loan with a term of just two or three years. While mini-perms may have a 25-year amortization, many are written on an interest-only basis.

What's the difference between a mini-perm and a bridge loan? Bridge loans are usually fast, expensive, short-term loans. In contrast, mini-perms come from commercial banks, and the interest rate is usually deliciously low.

Balance Sheet Lender:

You will recall that a balance sheet is just a list of a company's assets and liabilities, plus the values of each. The difference between the company's assets and liabilities is the company's net worth.

A balance sheet lender is a commercial lender that is lending its own dough, and who does not have to meet any other lender's criteria. The commercial loan is destined to just stay on the commercial lender's books - as an asset on the company's balance sheet. Hence the expression, "balance sheet lender". The commercial loan is not being originated to be resold to anyone else at a later date.

Balance sheet lenders have tremendous freedom to make exceptions. A balance sheet lender could make a third trust deed, behind a $15 million first and second mortgage, on a land lessor's interest in land. A balance sheet lender has the freedom to say, "I don't give a snot whether you think this is a good commercial loan or not. We like this commercial loan. We're funding this commercial loan and keeping it in our own portfolio."

50 Basis Point Treasury Movement:

A basis point is 1/100th of 1%. Therefore a 50 basis point move is 50/100 of 1% or one-half of one percent.

Many commercial lenders tie their interest rates to comparable U.S. Treasury securities. For example, if a commercial bank is making a 10-year, fixed rate loan, with one rate renogotiation at the end of year five, the bank may designate that the rate for the second five years will be 250 basis points (2.5%) over 5-year Treasuries. A 50 basis point Treasury movement could mean that the fixed interest rate for the second five years will be 50 basis points (0.5%) higher than the first five years.

Difference Between Accounts Receivable Financing and Factoring:

Banks and specialized commercial finance companies are the commercial lenders who finance accounts receivable. These commercial lenders make loans, secured by the accounts receivable (maybe at 50% of face value). If the borrower doesn't pay, the commercial lender "forecloses" on the accounts receivable.

Factoring is a far more desperate act. Factoring is the outright sale of accounts receivable to a factor at, say, 35 cents on the dollar. A "factor" is a company or wealthy investor who buys accounts receivable. Legally a factor is not a loan shark, but if a factor won't help you, your next stop may be the neighborhood loan shark.

First of all, why do we even care about preferred equity? Preferred equity is just a subject for the Big Boys working for the investment banks in New York, right? Well, that's been true up until now, but I predict that this form of commercial financing will becom

First of all, why do we even care about preferred equity? Preferred equity is just a subject for the Big Boys working for the investment banks in New York, right? Well, that's been true up until now, but I predict that this form of commercial financing will becom

Real estate investors buy commercial properties because such properties generate cash flow (net rental income). You will recall that we said that a Cap Rate is simply the return on your purchase price that you would earn if you bought an income property for all cash.

Real estate investors buy commercial properties because such properties generate cash flow (net rental income). You will recall that we said that a Cap Rate is simply the return on your purchase price that you would earn if you bought an income property for all cash.

Let's look at another example, but this time let's use the gross rent multiplier to compute the likely sales price or value of an apartment building. Suppose we're now looking at a 10-unit apartment building located just a few blocks away from the 12-plex (the above example) that sold last week for $1,350,000. We calculated the gross rent multiplier on the 12-plex to be 9.4, and let's assume the two buildings are roughly comparable (same neighborhood, similar condition, similar appeal).

Let's look at another example, but this time let's use the gross rent multiplier to compute the likely sales price or value of an apartment building. Suppose we're now looking at a 10-unit apartment building located just a few blocks away from the 12-plex (the above example) that sold last week for $1,350,000. We calculated the gross rent multiplier on the 12-plex to be 9.4, and let's assume the two buildings are roughly comparable (same neighborhood, similar condition, similar appeal).