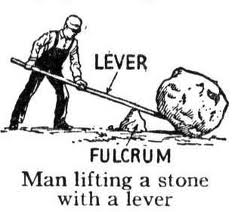

If you are a commercial mortgage broker or a commercial lender, you can supercharge your  volume of new commercial loans by using marketing leverage.

volume of new commercial loans by using marketing leverage.

Just imagine that you had a magic machine that multiplied every one of your marketing dollars by 400. For example, if you had just $100 to spend on marketing for commercial loans, this magic machine would suddenly turn that $100 marketing budget into a $4,000 marketing budget. Wouldn’t that be wonderful?

Such a magic machine actually exists. It’s not really a machine but rather a technique to take advantage of marketing leverage.

Here is that magical technique:

Advertise to the companies that are currently advertising.

Here’s how it works. The typical residential mortgage broker spends around $400 per month on marketing for mortgages. If you can reach this residential mortgage broker every three weeks with a $1 mail piece, and if he refers you every commercial loan request generated by his $400 marketing budget, then you have just achieved a 400:1 marketing leverage.

You can also achieve marketing leverage by mailing to banks and other commercial lenders. The typical commercial lender spends far more than $400 per month advertising for loans.

In theory, you could achieve similar marketing leverage working with a commercial real estate brokerage company sending newsletters or email newsletters to commercial property owners. If you could somehow hitch a ride in their newsletters, in return for a promise to pay them referral fees, you will have achieved substantial marketing leverage.

So look for mortgage companies and mortgage lenders that are advertising heavily for mortgage loans. These will be the guys with the most commercial leads to refer your way.

Did you find this article interesting? Why not make our blog, Commercial Real Estate Loan Tips, one of your home pages. I try to add a new article every other day.