C'mon, guys. This is fifth-grade math today. Don't tune out simply because you see a handful of easy algebraic expressions. Your math teach told you that you would need this stuff some day. Haha!

C'mon, guys. This is fifth-grade math today. Don't tune out simply because you see a handful of easy algebraic expressions. Your math teach told you that you would need this stuff some day. Haha!

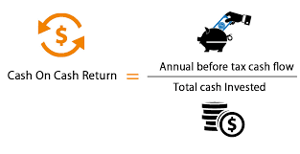

A cash-on-cash return is a form of yield calculated on real estate investments. It is seldom used for bond or other investments.

Lockdown Tip #1: Never leave your rice uncovered.

Your cash-on-cash return is your actual net cash flow, after debt service, divided by the amount of cash you invested, times 100% to convert it a percentage.

Example With No Leverage:

You buy an apartment building for $1 million all-cash. There are no mortgage payments. After all expenses, you net $57,000 in cash flow. Therefore -

Cash-on-Cash Return = (Net Cash Flow / Cash Invested) x 100%

Cash-on-Cash Return = ($57,000 / $1,000,000) x 100%

Cash-on-Cash Return = 0.057 x 100%

Cash-on-Cash Return = 5.7%

My golf buddies can be so cruel. Haha!

Remember, the above calculation assumes that you paid all cash for the apartment building.

"So, George, the cash-on-cash return is the same as the cap rate, right?"

Not quite. You will recall that that a cap rate is the return on investment that an investor would earn if he paid all cash for an income property.

It is calculated by dividing the projected Net Operating Income (NOI) by the purchase price (and then multiplying result by 100% to covert it to a percentage.)

Cap Rate = (NOI/Purchase Price) x 100%

But here's the thing. A property's net operating income (NOI) is really a budget for next year, assuming the use of a professional property management company. Included in that budget is a Reserve for Replacements to replace the roof, to replace the HVAC system, and to repave the parking lot.

A good rule of thumb, when preparing a Pro Forma Operating Statement for a commercial lender, is to use 3% of Effective Gross Income as your Reserve for Replacements.

The Effective Gross Income is the Gross Scheduled Income, plus any Parking Income and Vending Machine Income (which together is your Total Gross Income), less a 5% Reserve for Vacancy and Collection Loss. The remaining number is your Effective Gross Income.

A Pro Forma Operating Statement also makes a deduction for Professional Property Management - sometimes onsite management as well - even if the owner intends to manage the property himself.

In contrast, the Cash-on-Cash Return will not factor in a Reserve for Replacements, nor will it factor in a property management fee, if the owner intends to manage the property himself.

In real life, most real estate investors use a mortgage. Let's look at a cash-on-cash calculation where the borrower uses a mortgage.

Example With a Mortgage:

You buy an apartment building for $1 million. You put $300,000 down and get a $700,000 mortgage. The property throws off $57,000 per year in gross cash flow. The annual payments on the $700,000 mortgage are $32,000 per year.

What is your Cash-on-Cash Return?

Cash-on-Cash Return = (Net Cash Flow / Cash Invested) x 100%

Cash-on-Cash Return = ($57,000 - $32,000) / $300,000) all times 100%

Cash-on-Cash Return = 0.083 x 100%

Cash-on-Cash Return = 8.3%