If you need a commercial real estate loan right now, there are very few remaining commercial lenders from whom to choose.

If you need a commercial real estate loan right now, there are very few remaining commercial lenders from whom to choose.

Because of the Coronavirus Crisis, almost every commercial bank in the entire country is out of the commercial mortgage market.

Commercial banks are herd animals, and they are easily frightened. They are all waiting for the danger to completely pass before venturing timidly back into the market. "Oh, my Goodness, are we going to have a depression?" (Actually, we might.)

If you are a real estate developer, and you will be trying to get a commercial construction loan later in the year, you may really be screwed. I just can't see the banks coming back into the commercial real estate loan market for a very long while.

Quick Training Note:

In the first paragraph, I used the term, commercial bank, rather than just bank. This is to contrast a commercial bank from an investment bank or a merchant bank. Investment banks (think Goldman Sachs and Morgan Stanley) sell equity investments (stocks) and help companies to go public.

A merchant bank is a very different animal. Merchant banks today make very high interest rate loans (mezzanine loans, preferred equity investments, and venture equity), or they make direct equity investments in start-ups and young companies.

Merchant banks are often subsidiaries of bank holding companies and life insurance company holding companies. They are where the super-rich owners of banks and life companies speculate and gamble in high finance. There are probably fewer than 50 bona fide merchant banks remaining in the entire country. If you are ever at a commercial real estate finance trade show, and some guy describes himself as a merchant banker, 99% of the time he is full of poop.

The second training note is that 95% of all construction loans are made by commercial banks. This means that very few commercial construction loans will be made over the next three years. If your brother-in-law is a union carpenter, working in commercial construction, he may not be working for awhile.

Okay, Back to the Destruction of the Commercial Lending Market:

Last week I wrote that the asset-backed securities ("ABS") market is drying up. This means ABS commercial lenders, like Silver Hill, Velocity, and Cherrywood, are likely to remain out of the commercial loan market for a very long time.

CMBS bonds - investments secured by large first mortgages on shopping centers, office towers, and industrial centers - have taken a beating since the start of the Coronavirus Crisis. I think the plunge in CMBS bond values must be more than 20%. I can't see bond buyers rushing back into a low-yield market, where they just lost 20% of their principal.

As a result, no new CMBS loans are being closed... at all... period. The CMBS industry never completely recovered from the Great Recession, and this new setback may leave the industry without even the slightest wind in its sails for several more years.

It's really a shame. The CMBS loans written over the past five years have truly been of superb quality. "Hey, Federal Reserve and the Treasury Department, you can buy CMBS bonds right now, save the entire industry, and earn some really nice yields, all at no real risk to the U.S. taxpayer!"

But commercial real estate income has coodies right now. Eeeuuu. Don't touch it.

The abhorrence of any type of commercial real estate income is so bad that Freddie Mac and Fannie Mae, in their SBL apartment loan programs, won't let their underwriters use one penny of income from any commercial units. Let me explain this more clearly.

SBL stands for Small Balance Loans. Both Fannie Mae and Freddie Mac have competing apartment loan programs with terrific, low interest rates. Their Small Balance Loan programs are for apartment loans of between $1 million and $7 million.

Haha, I actually look like Albert Einstein myself.

Many apartment buildings in big cities are built as relative high-rises, and they have retail units on the ground floor. Perhaps one of the retail units will have a convenience store, a hairdresser, or a clothing store.

This type of building, with retail units on the bottom floor and apartments above them, is known as a mixed use building. Mixed use does not mean a mixed combination of office and retail units, nor does it mean retail units on the street and self storage units in the back. That is known as a mixed commercial center.

Historically, Fannie Mae and Freddie Mac will finance mixed use buildings, as long as the income from commercial units does not exceed 20% of the total scheduled income. But no longer.

Check out and bookmark our new Commercial Loan Resource Center:

While Fannie Mae and Freddie Mac will still finance mixed use buildings, they will not use even one penny of scheduled commercial income. The deal has to fly based solely on the income coming in from from the residential units. In other words, they will only go around 12% loan-to-value on mixed use properties right now. I'm kidding, of course, about the 12% LTV. They might even go 13% LTV. Haha!

Income from commercial real estate has coodies. Eeeuuu!

But then the bombshell dropped this week about hard money lenders. With the banks, the CMBS lenders, and the ABS commercial lenders out of the market, you would think that the hard money lenders would be making a killing.

A dear friend of mine, a fellow old veteran, read to a list to me this week of twenty-one of the largest commercial hard money lenders in the country that had either dropped out of the market or completely closed their doors. The list was a veritable bloodbath.

Each of these failed commercial hard money lenders had one thing in common. They were funds.

I have written extensively over the years that most hard money mortgage funds are almost Ponzi schemes. In order for the sponsor of a hard money mortgage fund to survive, it needs to be constantly bringing in new deposits and making new loans. It needs those new loan fees to make payroll and to pay for loan servicing and for the management of the inevitable foreclosed properties.

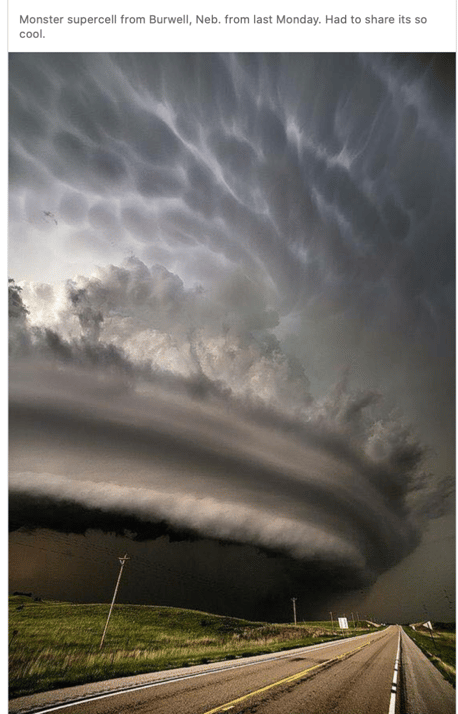

But here's the thing. Every twelve years or so (four times now since 1980), commercial real estate crashes by 45%. We had the S&L Crisis, the Dot-Com Meltdown, the Great Recession, and now the Coronavirus Crisis. Am I saying that commercial real estate will crash by 45% in this crisis? No one knows for sure, but if history holds true to form...

So when commercial real estate crashes, the private investors in these hard money mortgage funds all line up to withdraw. Yikes, there is no new money with which to make new loans. Any payoff's go to the investors lined up around the block to withdraw. No loan fee income is flowing into the sponsor of the hard money mortgage fund. He has no money with which to pay his loan servicing, property management, and accounting staff. Bam! The company goes belly-up.

So twenty-one of the largest commercial hard money mortgage funds have gone belly-up in the past three weeks. Who does that leave to make commercial loans?

Blackburne & Sons is one of about forty surviving commercial hard money shops that syndicate every loan that they make. We do not use a pool to fund our loans. We send out an announcement to our wealthy private investors, and then we assemble a syndicate of these guys to fund each loan. Every deal uses its own syndicate, and every syndicate has different members than the deal before.

I know that this sounds painfully slow, but the truth is that with email and DocuSign, it can be a very speedy process.

Summary:

Well over 98% of all commercial real estate lenders in the entire country are out of the market, and they are likely to remain out of the market for several years.

Even hard money lenders have gotten crushed. Fortunately, about forty hard money shops that syndicate every commercial loan have survived to help out through the Coronavirus Crisis.

Heavens, the world was doing so well. A trade deal had been reached with China. Unemployment was at fifty year lows. Real wages were increasing by over 3% per year. And then, bam! "Man plans, and God laughs." -- old Yiddish saying

Attention Commercial Loan Brokers:

My Heavens, this is the greatest time in the history of commercial loan brokerage for you to make money. You could make hundreds of thousands of dollars this year brokering commercial loans; so turn off Netflix and get your tail to work!

You can't rely on referrals in this market. Your will have to find the commercial borrowers yourself. But here's the thing - every business owner in the entire country needs cash right now! It's like shooting ducks in a barrel.

Go onto Google Maps. Plot your home or office address. Surrounding your office you will see scores of businesses. Call them!!!!! Speak to the owner. Does he own his commercial building? If so, you already know he needs cash. Start gathering up his loan package and get it to a commercial hard money shop that syndicates its investors to fund deals.

Naturally, I recommend Blackburne & Sons. Oh, my goodness, you could make soooo much money right now. American businessmen desperately need you because you know the one place to get money. Work!