I have a real treat for you today. A buddy of mine, Yoni Miller of QuickLiquidity.com, makes preferred equity investments and second mortgage loans on commercial property. He has generously agreed to write today's fascinating blog article about all of the unique types of preferred equity investments and commercial second mortgages that junior commercial lenders can make.

I have a real treat for you today. A buddy of mine, Yoni Miller of QuickLiquidity.com, makes preferred equity investments and second mortgage loans on commercial property. He has generously agreed to write today's fascinating blog article about all of the unique types of preferred equity investments and commercial second mortgages that junior commercial lenders can make.

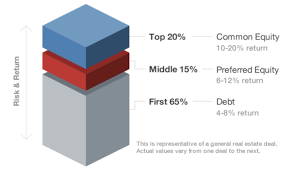

Before we get into Yoni's wonderful article, I first just want to give you a quick refresher course on preferred equity investments. Preferred equity is similar to a second mortgage on a commercial property. You own a $6 million shopping center, and you owe just $2.5 million against it. You need $1 million to convert a former K-Mart space into self-storage space.

You just can't go out and refinance the building because you have a defeasance prepayment penalty. You would have to pay a prepayment penalty of $850,000 just to borrow $1 million. The first mortgage loan documents prohibits second mortgages. You can't even put a mezzanine loan on the property because the first mortgage loan documents prohibit mezzanine loans too. The trust that bought the first mortgage does not want the owner to take on any additional loan payments.

A preferred equity investment is NOT a loan. Therefore it does NOT have any loan payments. A preferred equity investment is a purchase of some of the membership interests (think of shares of stock) in the limited liability company (think of a corporation) that owns the commercial property.

The preferred equity investor only gets paid if the property is generating enough cash flow. Because the investment is preferred, the preferred equity investor gets a paid its return first, right after the first mortgage payment, but before any of the other owners of the property can pull out a dime.

Now on to Yoni's insightful article. Who knew such unique financing and liquidity strategies actually existed?

Commercial real estate owners strive to create additional equity in their investment properties. (George: By renovating the property, leasing out vacant units, replacing existing tenants with higher paying tenants, and paying down on the first mortgage.) Once they have created a significant amount of equity, they unfortunately have few ways to monetize it. (George: Pay attention here folks. Lots of investors have tons of equity, but they don't know how to monetize it!)

The most common way to monetize equity in a commercial real estate investment is a cash-out refinance, but some borrowers' existing first mortgages have hefty prepayment penalties, meaning if they were to refinance and payoff their existing mortgage, they have to pay extra fees, which can vary greatly. In many cases these prepayment penalties make it costly to do a cash-out refinance with a new lender, making them look for alternative options for them to monetize their equity.

Two of the most popular options are second mortgages and equity recapitalizations, which may allow them to monetize their equity without disturbing their existing first mortgage. Let’s discuss what each of those are and then provide a few real life examples.

What is a “Second Mortgage”?

Investopedia answers the questions for us. “A second mortgage is a type of subordinate mortgage, made while an original mortgage is still in effect. In the event of default, the original mortgage would receive all proceeds from the liquidation of the property until it is all paid off. Since the second mortgage would receive repayments only when the first mortgage has been paid off, the interest rate charged for the second mortgage tends to be higher and the amount borrowed will be lower than that of the first mortgage.”

What is a “Equity Recapitalization”?

An equity recapitalization in commercial real estate is changing the mix of the capital that creates the real estate capital stack (George: On $100 million office building purchases in New York City, the capital stack often gets very, very layered. For example, there's the first mortgage, then mezzanine loan #1, then mezzanine loan #2, then the senior preferred equity, then the junior preferred equity, then the venture equity, and finally the developer's or borrower's cash contribution.)

An equity recapitalization is often done to buy out existing partners, create liquidity for new investment opportunities, or for capital needed for tenant improvements. A common way to achieve this is by bringing in a new capital partner or preferred equity investor. This helps an owner create the liquidity they need without giving up management control or majority ownership of the property.

Here are four examples of how QuickLiquidity, a direct lender and preferred equity investor recently helped commercial real estate owners and limited partners monetize their existing equity.

1) QuickLiquidity funded a $1.4 million second mortgage on a $50 million shopping center located in a suburb of Kansas City, MO. The borrower, who is an experienced developer, needed to monetize his equity in a 235,000-square-foot shopping center without refinancing their existing first mortgage. The borrower had recently created significant equity in the shopping center by redeveloping it and securing new long-term leases with national tenants. The borrower's existing first mortgage lender would not increase their loan for the purposes of a cash-out, leaving the borrower with a limited amount of financially feasible options to quickly monetize their equity. If the borrower were to refinance their first mortgage with a new lender, the closing costs and fees to replace the large first mortgage would be significant compared to the relatively small $1.4 million cash-out amount. QuickLiquidity offered a solution by providing the borrower with a second mortgage on the property. This saved the borrower a ton of money in fees and provided them with the capital they needed in the time frame they needed.

2) QuickLiquidity purchased a 2.53% partial interest for $460,000 in a real estate partnership that owns a 199-unit apartment community in Fairfax, VA. (George: Pay attention here. QuickLiquidity actually purchased a tiny interest in the LLC that owned the property. This was NOT a preferred equity investment. After the purchase, the interest that QuickLiquidty purchased was pari passou with that of the other investors in the project. In the words of the Church Lady, QuickLiquidity was NOT special.) The seller inherited the partial interest over 30 years ago and was seeking an immediate exit strategy from their illiquid and non-controlling interest. By QuickLiquidity coming in as a new passive investor, the seller was able to receive immediate liquidity without having to wait until the partnership decides to sell the property, which might not occur for many years.

3) QuickLiquidity provided $1 million of post-petition debtor-in-possession (DIP) financing to a commercial real estate investment fund in Chapter 11 bankruptcy. The DIP financing is secured by a priority lien against the funds ownership interests in 5 properties totaling almost 500,000-square-feet, between three office buildings and two retail shopping centers. This loan provided the necessary capital to allow the fund to operate while pursuing a confirmable plan of reorganization.

4) QuickLiquidity made a $500,000 loan secured by a 9.39% illiquid and non-controlling ownership interest in a $30 million shopping center located near Cincinnati, OH. The property is 320,000-square-feet. The shopping center is 100 percent occupied, with its anchor tenants being The Home Depot, Kroger, and Kohl’s, who have leases that continue until 2024 and 2025. The borrower looked to monetize its illiquid and non-controlling ownership interest to access capital in order to invest in a time sensitive real estate development deal. By bringing in QuickLiquidity as the lender, the borrower was able to receive the capital he needed, while maintaining complete ownership of his interest. (George: Note, unlike example 2 above, QuickLiquidity did NOT buy the borrower's membership interest in the LLC that owned the shopping center. Instead, they made a loan against it. This is incredibly rare and invaluable to know.) This allows the borrower to receive the property’s future appreciation and upside, while leveraging his existing investment. QuickLiquidity is a direct lender and preferred equity investor providing equity recapitalizations, subordinated debt and partner buyouts on commercial real estate nationwide. QuickLiquidity allows real estate owners to monetize their existing equity while maintaining majority ownership and control of their property without disturbing their existing first mortgage or triggering any prepayment penalties. For more information you can visit www.quickliquidity.com/recapitalizations.html or call Yoni Miller 561-221-0881.

QuickLiquidity is a direct lender and preferred equity investor providing equity recapitalizations, subordinated debt and partner buyouts on commercial real estate nationwide. QuickLiquidity allows real estate owners to monetize their existing equity while maintaining majority ownership and control of their property without disturbing their existing first mortgage or triggering any prepayment penalties. For more information you can visit www.quickliquidity.com/recapitalizations.html or call Yoni Miller 561-221-0881.